Will a rate cut spur further building boom in Windsor? Maybe

The latest interest rate cut may not open the floodgates of construction in Windsor-Essex, according to the area’s home builders’ association.

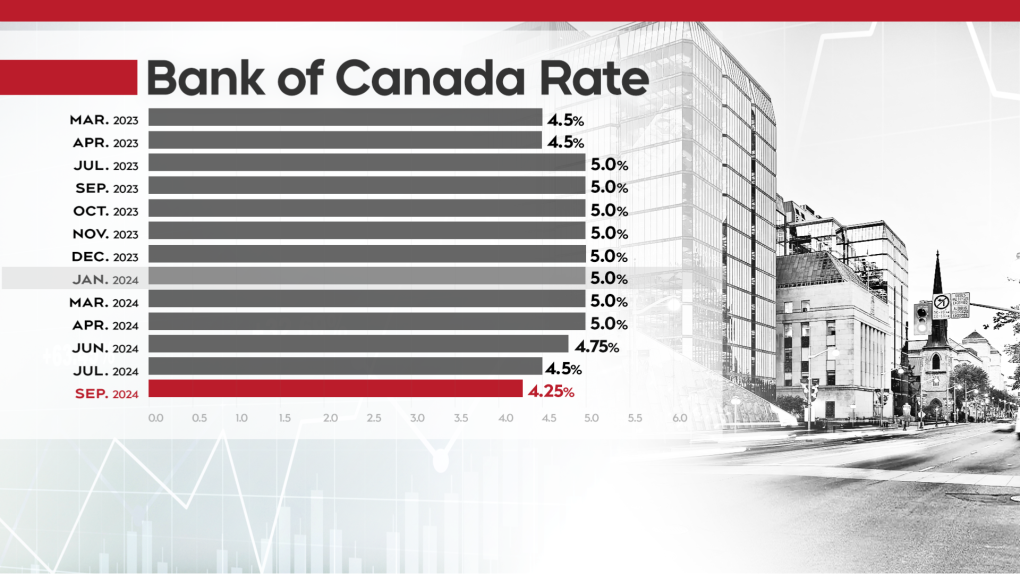

Last Wednesday, the Bank of Canada cut its benchmark rate 25 basis points to 4.25 per cent, but that may not be enough to light a fire under developers who cite high borrowing costs for sitting on the sidelines.

“I don’t think there’s necessarily a number that’s going to light that fuse,” said Brent Klundert, chair of the Windsor-Essex Home Builders’ Association.

He points to several factors, like elevated construction costs, fluctuating pre-sale demand and cumbersome red tape, as hurdles to beginning major projects.

“It’s more of the inventory that’s sitting versus the sales and the customer sentiment and the things that have to return to our market in order to tip the scales,” said Klundert

It all depends on the figures in each developer’s budget, said Klundert. The numbers are “baked in” for major projects and when the conditions allow, that’s when workers will get digging.

In Windsor, the number of building permits turning into construction projects is climbing.

On Friday, the city announced it was on track to top its annual provincial target of 1,083 housing starts this year, toward the 10-year goal of 13,000 new units by 2031.

The city reports 924 housing starts as of Aug.14, accounting for 85 per cent of its 2024 goal.

That follows a slow year in 2023, amid elevated interest rates, that saw the city miss its provincial target of 953 housing starts — despite the Canada Mortgage and Housing Corporation (CMHC) reporting the city achieved 1,208 housing starts that year.

In its Spring 2024 Housing Outlook Report, the CMHC projected a housing rebound in 2024 due to increased demand for new homes and the pace of apartment starts to be maintained “supported by declining financing costs”, along with the continued strong rental demand.

In his news conference announcing the rate cut, Bank of Canada Governor, Tiff Macklem, confirmed a steeper 50-point basis cut was discussed, but ultimately decided against.

Klundert suggests a future cut in that vein may be enough to entice more developers to fire up the excavators.

“It definitely could be the spark that ignites the fire back again,” said Klundert. “To say that without a shadow [of a doubt] that 25 basis point difference between a 25 point and a 50 point [drop] would be the tipping point. Hard to say.”

The Bank of Canada is set to make its next rate announcement on Oct. 25.

CTVNews.ca Top Stories

W5 Investigates A 'ticking time bomb': Inside Syria's toughest prison holding accused high-ranking ISIS members

In the last of a three-part investigation, W5's Avery Haines was given rare access to a Syrian prison, where thousands of accused high-ranking ISIS members are being held.

'Mayday!': New details emerge after Boeing plane makes emergency landing at Mirabel airport

New details suggest that there were communication issues between the pilots of a charter flight and the control tower at Montreal's Mirabel airport when a Boeing 737 made an emergency landing on Wednesday.

BREAKING Supreme Court affirms constitutionality of B.C. law on opioid health costs recovery

Canada's top court has affirmed the constitutionality of a law that would allow British Columbia to pursue a class-action lawsuit against opioid providers on behalf of other provinces, the territories and the federal government.

Cucumbers sold in Ontario, other provinces recalled over possible salmonella contamination

A U.S. company is recalling cucumbers sold in Ontario and other Canadian provinces due to possible salmonella contamination.

Irregular sleep patterns may raise risk of heart attack and stroke, study suggests

Sleeping and waking up at different times is associated with an increased risk of heart attack and stroke, even for people who get the recommended amount of sleep, according to new research.

Real GDP per capita declines for 6th consecutive quarter, household savings rise

Statistics Canada says the economy grew at an annualized pace of one per cent during the third quarter, in line with economists' expectations.

Nick Cannon says he's seeking help for narcissistic personality disorder

Nick Cannon has spoken out about his recent diagnosis of narcissistic personality disorder, saying 'I need help.'

California man who went missing for 25 years found after sister sees his picture in the news

It’s a Thanksgiving miracle for one California family after a man who went missing in 1999 was found 25 years later when his sister saw a photo of him in an online article, authorities said.

As Australia bans social media for children, Quebec is paying close attention

As Australia moves to ban social media for children under 16, Quebec is debating whether to follow suit.