Bank of Canada holds interest rate at 5% and Windsor-Essex realtor is 'kind of glad it did'

The Bank of Canada held its policy rate at 5 per cent on Wednesday, saying it needs to see a sustained decline in inflation before rate cuts can begin.

“I realize that what most Canadians want to know is when we will lower our policy interest rate,” said Bank of Canada Governor Tiff Macklem. “What do we need to see to be convinced it’s time to cut? The short answer is we are starting to see what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained.”

The central bank projects inflation to ease from 3 per cent earlier in of 2024 to 2.5 per cent by the end of this year. Inflation is expected to return to target by 2025, and fell to 2.8 per cent in February.

Macklem did leave the door open for a possible rate cut in June during a news conference with reporters in Ottawa on Wednesday.

"Yes, it is within the realm of possibilities," he said. "Look, I think we have been pretty clear, we are encouraged by what we have seen since January."

While progress has been made in cooling inflation, costs in services and food remain elevated.

There are also risks that remain that could potentially drive inflation up again.

The central bank is concerned about three main areas that could push inflation higher. House prices could rise more than anticipated due stronger demand on supply. Shelter price inflation remains high at 7 per cent, driven by high mortgage costs and strong growth in rent.

Business experts say holding the rate is a measure to avoid a major spark in an already tight real estate market, which is one factor keeping inflation up.

“Of course they are worried about igniting a spring rally in house prices. If people think rates are coming down, even if it's only a slight drop, if people think, ‘Well that's the story now, it's going to get cheaper. We're going to ask more for our house.’ Some people are going to possibly get into bidding wars anticipating a rise,” said Andrew Bell of BNN Bloomberg.

Windsor-Essex real estate broker Joe Conlon isn’t surprised with the news.

“We expected it to hold and I'm kind of glad it did,” said Conlon, adding that the spring market is seeing bidding wars and price escalation already, even without any rate cuts. “Buyers are starting to get nervous that they're seeing the competition come back right now without the rate drop and if the rates come down too soon, I think their fear is that things are going to get even crazier and out of hand.”

The Bank of Canada’s decision to hold the rate will be painful for people who are coming up on mortgage renewals, Conlon said,

“I kind of feel for them where they're the ones that had locked in low rates about five years ago. But the first time homebuyers those are the ones that are eager for rates to come down, but I don't know if they should be so eager,” he said.

The average sale price for a home in Windsor-Essex in March was $563,309, a marginal decrease from the previous month.

House sales were down 10.29 per cent in March and listings dipped 4.39 per cent.

“If you cut too soon, you're just going to put yourself right back in a situation in which we found ourselves with things going up and up and up, and all of a sudden quickly,” said Christian Conlon, a real estate agent with the Joe Conlon Real Estate Team. “People start to find out that it's not going to stay this way and at some point, something's got to change.”

A rate cut is widely anticipated in either early June or July.

—With files from CTVNews.ca

CTVNews.ca Top Stories

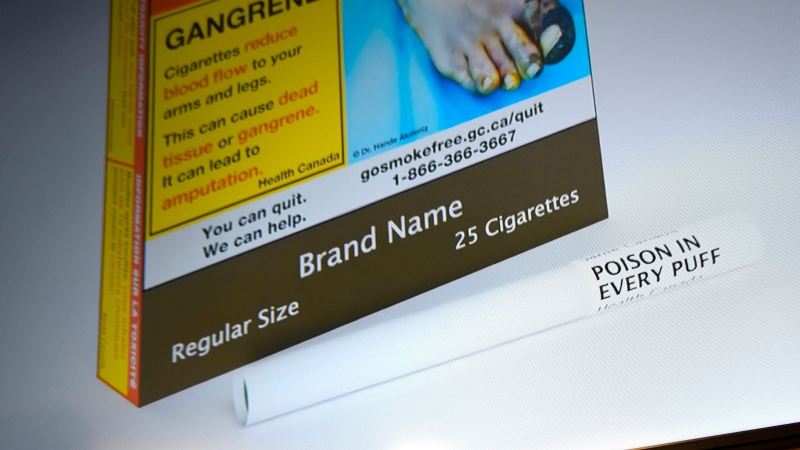

In a world first, king-size cigarettes in Canada must feature one of these warnings starting Tuesday

Tobacco manufacturers have until Tuesday to ensure every king-size cigarette produced for sale in Canada has a health warning printed directly on it.

Norovirus spreading at 'higher frequency' than expected in Canada

Norovirus is spreading at a 'higher frequency' than expected in Canada, specifically, in Ontario and Alberta, according to the Public Health Agency of Canada.

French actor Gerard Depardieu released after questioning over alleged sexual assaults

French actor Gerard Depardieu was questioned by police on Monday in connection with alleged sexual assaults against two women on separate film sets, police sources said, and was released without charge.

WATCH So you haven't filed your taxes yet…

The clock is ticking ahead of the deadline to file a 2024 income tax return. A personal finance expert explains why you should get them done -- even if you owe more than you can pay.

Wet weather to plague provinces, some areas to see up to 45 millimetres of rain

The same storm system that brought deadly tornadoes to parts of the U.S. is heading north, hammering some Canadian provinces with rain and snow, according to latest forecasts.

'I feel honoured to say I was his friend': Wayne Gretzky remembers Bob Cole

Tributes continue to pour in for Bob Cole as his family has confirmed a funeral will be held for the legendary broadcaster Friday in St. John's, N.L.

Majority of aspiring homeowners awaiting rate cuts before buying: BMO survey

The majority of Canadians aspiring to buy a home say they will push their plans to next year or later to wait for interest rates to drop, a new survey shows.

Third youth charged with second-degree murder in death of 16-year-old: Halifax police

Police have charged a third youth in connection with the death of a teenager in Halifax last week.

Anne Hathaway reveals she's now five years sober

Anne Hathaway first shared she lost interest in drinking after a bad hangover in 2018. She’s now five years sober.