'They cause blight in the neighbourhood': Council approves vacant house tax

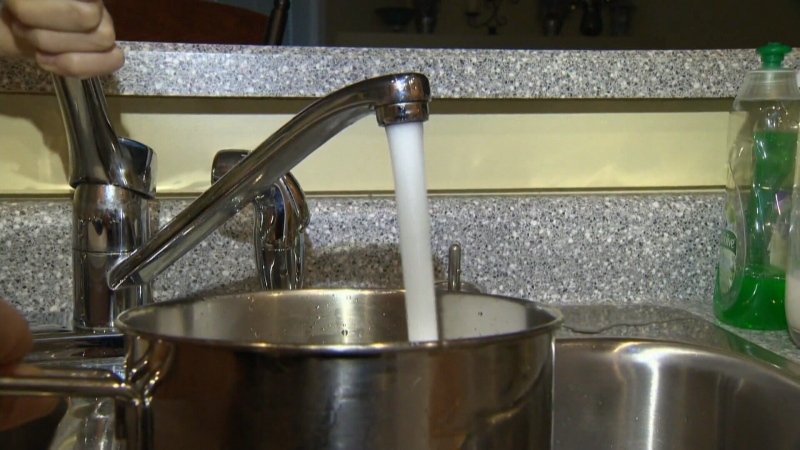

The City of Windsor is putting owners of vacant homes on notice.

City of Windsor chief building official John Revell said the new vacant home tax will be another useful tool for the city.

“Largely aimed at speculators who are sitting on properties and holding them in hopes the values go up and they can resell them to make a quick profit and don’t have to bother too much renovating the house or dealing with tenants,” Revell said.

“Often times these vacant homes are left to rot. They cause blight in the neighbourhood, they cause rodent infestation because they are not taken care of, they are not activated,” says Ward 2 councillor Fabio Costante.

Council voted during 2022 budget deliberations to have administration move forward with a vacant house tax proposed by Costante.

“This is one lever at our disposal to start encouraging more housing in our community,” he says.

The city has identified 165 residential properties that are currently designated as vacant. These properties include 30 owned by the company which controls the Ambassador Bridge.

Costante says it’s one way to address the affordable housing crisis by encouraging owners to sell or lower rents to find tenants.

“The CTC, the out-of-town landlord, the property owner that is not caring for their home, they are on notice now and we have this lever at our disposal and council unanimously endorsed it and I am looking forward to its roll out,” says Costante.

Properties that sit empty for more than 90 days will be hit.

“We have a shortage of housing, and rents are increasing and house prices are increasing so it’s market driven. So we would like to see properties back and available for people to live in. We’d like to see homes that need to be repaired, repaired and in a good state,” says Revell.

The tax could range between 1-2 per cent of the assessed value of the home.

“In real dollars we are looking at somewhere in the range of $2,000-$3,000 per property could be the added penalty in addition to paying property taxes already,” says Costante. “In addition, other penalties we could impose if they fail to register or if they try to abdicate the responsibilities through this new directive.”

The Downtown Mission feels this is good news.

“There are so many people out there that can’t find an affordable apartment or home or anything like that so to have extra opportunity would be wonderful,” says interim executive director Rukshini Ponniah-Goulin.

“It’s a critical piece of the overall puzzle enforcing property standards and creating more opportunity for safe and accessible housing,” says Costante.

A consultation period will be held in the coming months to address issues such as longer term absences and ongoing renovations before a bylaw takes effect.

CTVNews.ca Top Stories

W5 Investigates 'Let me rot in Canada,' pleads Canadian ISIS suspect from secret Syrian prison

W5's Avery Haines tells the story of Jack Letts, a Canadian Muslim convert in a Syrian jail, accused of being a member of ISIS. In part two of a three-part investigation, Haines speaks with Letts, who issues a plea to return to Canada to face justice.

Ford pushes for 'more proactive' border action after Trudeau meets with premiers about Trump

Ontario Premier Doug Ford is calling on the federal government to 'take a more proactive approach at the border' following a call Wednesday night between Prime Minister Justin Trudeau and all 13 premiers to discuss U.S. president-elect Donald Trump's tariff threat.

Liberals table GST holiday legislation, putting $250 rebate on backburner

Prime Minister Justin Trudeau's promised holiday consumer relief package has been split in half. After NDP Leader Jagmeet Singh said his party was only ready to help pass the GST/HST holiday portion of the affordability announcement, Deputy Prime Minister and Finance Minister Chrystia Freeland tabled legislation Wednesday that only seeks to enact that measure.

Missing hiker found alive after 50 days in northern B.C. wilderness

A missing hiker who spent 50 days alone in the frozen wilderness of northern British Columbia has been found alive.

Boeing plane makes emergency landing at Montreal's Mirabel airport after landing gear malfunction

No injuries were reported after a Boeing 737 was forced to divert to Mirabel airport after the aircraft experienced a technical issue with the landing gear.

Montreal billionaire Robert Miller could have as many as 100 victims, lawyer says

A Quebec judge is hearing arguments this week in a class-action lawsuit application against Montreal billionaire Robert Miller over allegations he paid minors for sex.

It's expensive to visit the Maldives. Now it's more expensive to leave, too

The Indian Ocean archipelago nation of the Maldives, known for its white sand beaches and coral reefs, has just increased the price it costs to leave.

Two Canadians arrested for failed murder plot in California

Two men who travelled from Canada to Monterey County have been arrested and accused of attempted murder after a triple-stabbing Sunday.

Northern lights forecast to fill the skies in Midwest U.S., some areas in Canada

The northern lights could be visible for residents in northern and upper Midwest states in the U.S. as early as Thursday, including some Canadian provinces.