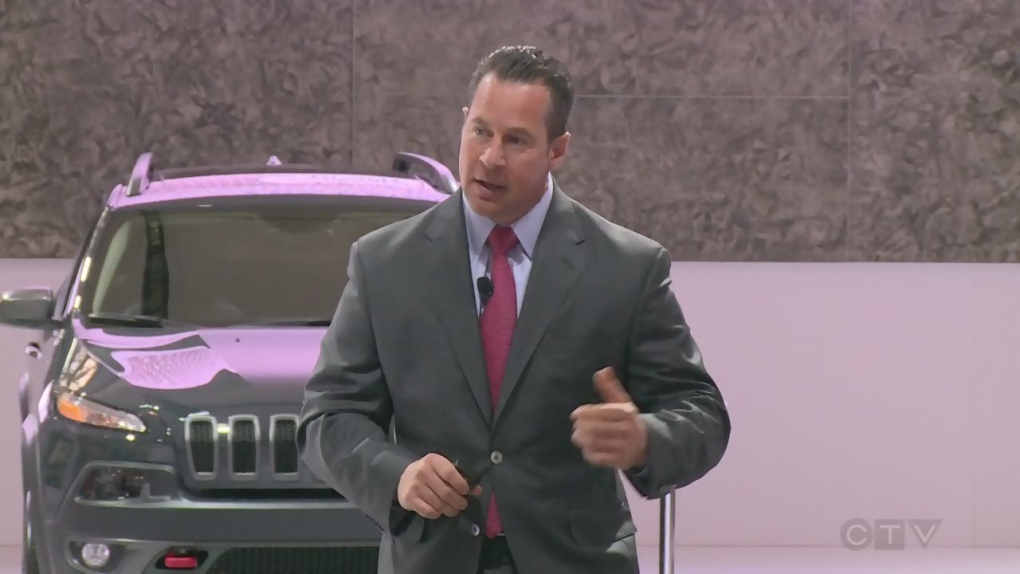

DETROIT -- Fiat Chrysler's U.S. sales chief is suing the company, alleging that it withheld 90 per cent of his pay package because he testified in a government inquiry of sales reporting practices.

Reid Bigland, who has been with the company for 22 years, alleges that Fiat Chrysler Automobiles violated Michigan's Whistleblower Protection Act, retaliating against him because he testified before the Securities and Exchange Commission in a probe of whether the company inflated sales and deceived stockholders.

The company withheld Bigland's 2018 long-term incentive stock payout, special dividends and an annual bonus in retaliation for his testimony and because he sold some stock, according to the lawsuit. Documents say the dividends alone are worth about $1.8 million.

The lawsuit is another in a long string of legal troubles for Fiat Chrysler, which also faces federal investigations into illegal payments to union officials through a training centre and a criminal probe into allegations that its diesel-powered trucks were programmed to cheat on emissions tests. The company has denied cheating.

In a statement, Fiat Chrysler said the compensation committee of its board still needs to determine whether Bigland met company and personal performance conditions. "Mr. Bigland's eligibility for his award remains subject to that determination and completion of a board-level evaluation of issues that are the subject to governmental investigations in which FCA continues to co-operate," the company said, adding that further comment on pending litigation would be inappropriate.

Fiat Chrysler filed paperwork Wednesday seeking to have Bigland's case heard in the federal courts. It was filed May 24 in a state court in Pontiac near Fiat Chrysler's U.S. headquarters.

Bigland, who also is head of Fiat Chrysler's Ram brand and its Canadian operations, remains with the company.

His lawsuit said that he inherited the sales reporting system when he took over the top sales job in 2011. When a dealer sued the company over the reporting system in 2016, Fiat Chrysler reported problems to the SEC, according to the documents.

The company, in its motion to transfer the case to federal courts, tried to cast doubt on Bigland's whistleblower claims. It said Bigland acknowledges that Fiat Chrysler reported the problems itself and that he didn't testify voluntarily before the commission.

The dealer's lawsuit forced Fiat Chrysler to revise more than five years of U.S. sales figures and to admit that a much-touted streak of 75 months of sales gains should have ended in 2013.

The company said in 2016 that it would change the way it reports monthly sales retroactively to the start of 2011.

Higher monthly sales could influence the company's stock price, drawing the attention of the SEC and the Justice Department, both of which are investigating.

At the time the company said it had a "reserve" stock of cars that had been shipped to big fleet buyers such as rental car companies but not recorded as sales. Managers had the ability to move those sales from one month to the next to make sure the company reported positive numbers. It now records sales as soon as vehicles are shipped to customers, the company said.

Also, dealers sign paperwork to sell a vehicle and then report it as a sale to Fiat Chrysler. In the past, the sale might fall through because the customer backs out or can't get financing. Previously FCA still counted these as sales, but made sure it didn't count the same vehicle when it was sold later. Now the company subtracts sales when it finds out the deal was scuttled.