Windsor-Essex brewers lament impact of looming 6.3% alcohol tax

Chapter Two Brewing Company in Windsor is celebrating a milestone this weekend.

“Five years! We're pretty pumped that we got this far and we're still going strong,” said brewery co-owner and general manager, Cheryl Watson. “It’s good news, I mean, we’ve gone through a lot.”

From the impact of lockdowns during the pandemic to recent inflationary pressures and wage increases, Watson notes the cost of doing business has been steep.

And that anniversary celebration will clouded by a looming alcohol excise tax increase on all alcohol producers.

“I think everything is just, it's been unpredictable for suppliers and buyers alike,” Watson said. “We have to look at and figure out what part of it you're going to cover and what part of it you're going to ask your customer to cover.”

That question will get harder on April 1 when the 6.3 per cent federal excise tax goes into effect on beer, wine and spirits producers.

Taxes already make up 50 per cent of the cost of beer, 65 per cent of the cost of wine and 75 per cent spirits, according to the Canadian Taxpayers Federation.

“The screws are tightening and we don't have as many places to play anymore,” said Watson.

The increase on the table is triple the usual jump — a number tied directly to inflation — and has alcohol manufacturers wondering who is going to pick up the tab.

“You're going to see probably a six to 10 per cent increase on the price of your beer,” said Shane Meloche, the owner of Frank Brewing Company in Windsor. He’s weathered the storm that is the past few years in the hospitality industry and doesn’t want to raise prices but worries this time, he may have no choice.

“We're here to make money. We've got 20 to 30 people that work here. We need to stay in business,” Meloche said. “We want to keep everybody employed. So the only way to do that is to pass along that price to the consumer.”

Restaurants who sell alcohol will also feel the effects. A recent Restaurants Canada survey found about half of Canadian restaurants are operating just at or below profitability levels, noting the tax increase will cost Canada's food-service industry about $750 million a year.

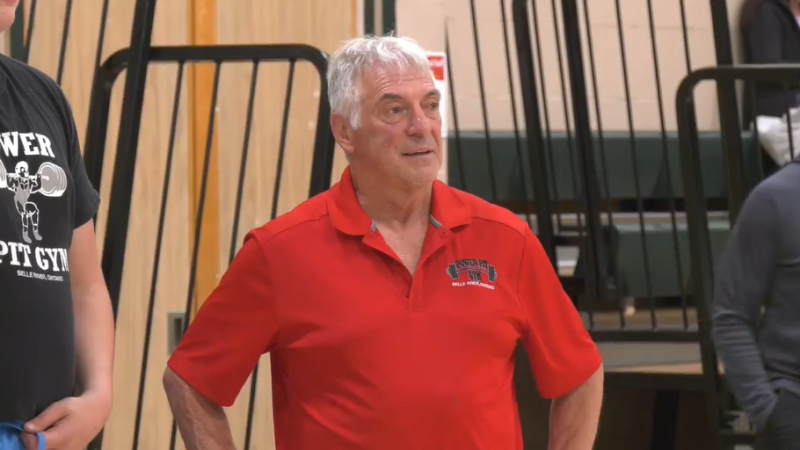

“Their profit margins are very slim. And then when you have a six per cent increase, it's slimmer,” said Paul Boots, who along with business partner John Conlon launched Suds Runner just a few months back.

It’s a licensed manufacturing representative retailer for nine different Breweries in Ontario where customers can go online and order flights of beer from them that you can’t get at the LCBO or Beer Store — and they bring it to your door.

They started the venture to support local breweries and give their less popular brews more exposure for customers who can’t make it out to craft breweries as often as they’d like.

They hope the increase doesn’t crush their suppliers, customers, or them.

“It's important, I think, for people to understand that if the price is going up a little bit, it's not because they're making more money,” said Conlon.

“They're just trying to work, trying to make it work.”

CTVNews.ca Top Stories

Spectacular aurora light show to be seen across Canada Friday night

A rare and severe solar storm is expected to bring spectacular displays of the northern lights, also known as aurora borealis, across much of Canada and parts of the United States on Friday night.

Which Canadian cities have the highest and lowest grocery prices?

Where you live plays a big factor in what you pay at the grocery store. And while it's no secret the same item may have a different price depending on the store, city or province, we wanted to see just how big the differences are, and why.

BREAKING McGill University seeks emergency injunction to remove pro-Palestinian encampment from campus

McGill University has filed a request for an injunction to have the pro-Palestinian encampment removed from its campus.

Swarm of 20,000 bees gather around woman’s car west of Toronto

A swarm of roughly 20,000 bees gathered around a woman’s car in the parking lot of Burlington Centre.

U.S. says Israel's use of U.S. arms likely violated international law, but evidence is incomplete

The Biden administration said Friday that Israel's use of U.S.-provided weapons in Gaza likely violated international humanitarian law but wartime conditions prevented U.S. officials from determining that for certain in specific airstrikes.

'State or state-sponsored actor' believed to be behind B.C. government hacks

The head of British Columbia’s civil service has revealed that a “state or state-sponsored actor” is behind multiple cyber-security incidents against provincial government networks.

Mother assaulted by stranger while breastfeeding baby in her car: Vancouver police

A person was arrested in East Vancouver Thursday after allegedly entering a car while a mother was breastfeeding her four-month-old boy.

More than half the Canadians once detained in Syrian camps for suspected ISIS family members have returned home

A total of 29 Canadians have been freed from detention camps in northeast Syria and brought back to Canada since human rights advocates began lobbying for their release years ago.

Canada abstains from Palestinian UN membership vote but supports two-state solution

Canada was one of 25 countries that abstained from a United Nations vote on Palestinian membership that passed with overwhelming support on Friday.