Windsor-Essex brewers lament impact of looming 6.3% alcohol tax

Chapter Two Brewing Company in Windsor is celebrating a milestone this weekend.

“Five years! We're pretty pumped that we got this far and we're still going strong,” said brewery co-owner and general manager, Cheryl Watson. “It’s good news, I mean, we’ve gone through a lot.”

From the impact of lockdowns during the pandemic to recent inflationary pressures and wage increases, Watson notes the cost of doing business has been steep.

And that anniversary celebration will clouded by a looming alcohol excise tax increase on all alcohol producers.

“I think everything is just, it's been unpredictable for suppliers and buyers alike,” Watson said. “We have to look at and figure out what part of it you're going to cover and what part of it you're going to ask your customer to cover.”

That question will get harder on April 1 when the 6.3 per cent federal excise tax goes into effect on beer, wine and spirits producers.

Taxes already make up 50 per cent of the cost of beer, 65 per cent of the cost of wine and 75 per cent spirits, according to the Canadian Taxpayers Federation.

“The screws are tightening and we don't have as many places to play anymore,” said Watson.

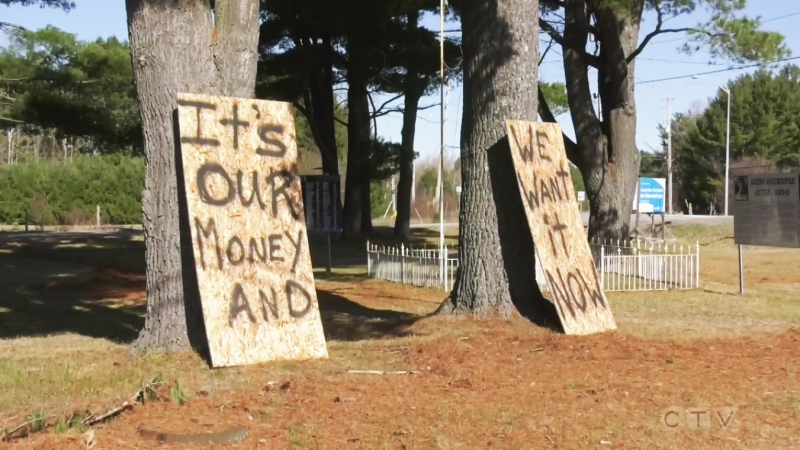

The increase on the table is triple the usual jump — a number tied directly to inflation — and has alcohol manufacturers wondering who is going to pick up the tab.

“You're going to see probably a six to 10 per cent increase on the price of your beer,” said Shane Meloche, the owner of Frank Brewing Company in Windsor. He’s weathered the storm that is the past few years in the hospitality industry and doesn’t want to raise prices but worries this time, he may have no choice.

“We're here to make money. We've got 20 to 30 people that work here. We need to stay in business,” Meloche said. “We want to keep everybody employed. So the only way to do that is to pass along that price to the consumer.”

Restaurants who sell alcohol will also feel the effects. A recent Restaurants Canada survey found about half of Canadian restaurants are operating just at or below profitability levels, noting the tax increase will cost Canada's food-service industry about $750 million a year.

“Their profit margins are very slim. And then when you have a six per cent increase, it's slimmer,” said Paul Boots, who along with business partner John Conlon launched Suds Runner just a few months back.

It’s a licensed manufacturing representative retailer for nine different Breweries in Ontario where customers can go online and order flights of beer from them that you can’t get at the LCBO or Beer Store — and they bring it to your door.

They started the venture to support local breweries and give their less popular brews more exposure for customers who can’t make it out to craft breweries as often as they’d like.

They hope the increase doesn’t crush their suppliers, customers, or them.

“It's important, I think, for people to understand that if the price is going up a little bit, it's not because they're making more money,” said Conlon.

“They're just trying to work, trying to make it work.”

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Ex-tabloid publisher testifies he scooped up possibly damaging tales to shield his old friend Trump

As Donald Trump was running for president in 2016, his old friend at the National Enquirer was scooping up potentially damaging stories about the candidate and paying out tens of thousands of dollars to keep them from the public eye.

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.