Licensed marijuana producer Aphria Inc. announced an agreement Monday to buy medical cannabis firm Nuuvera Inc. in a cash-and-stock deal that it says values the company at $826 million.

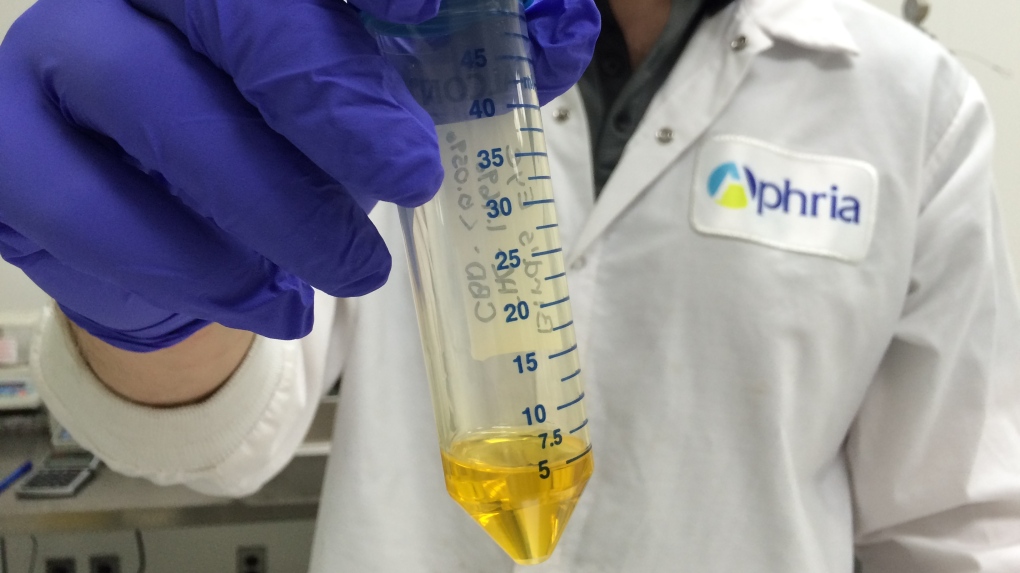

The deal builds on a partnership between the companies as it combines Aphria's production with Nuuvera's expertise in cannabis processing and extraction. The combination will also help grow Aphria's international footprint.

``The combination of Aphria and Nuuvera creates a true global leader in medical cannabis with excellent potential for growth and value creation,'' Aphria chief executive Vic Neufeld said in a statement.

This deal is yet another sign of consolidation, less than a week after Aurora Cannabis Inc. reached a friendly billion-dollar to acquire rival licensed producer CanniMed Therapeutics Inc. for a mix of cash and stock in the biggest acquisition the marijuana sector has seen. As well, earlier this month Aphria announced a deal to buy B.C.-based Broken Coast Cannabis Inc., a transaction valued at $230 million.

Analysts expect consolidation to accelerate in the sector ahead of the legalization for recreational use of marijuana this summer.

Under the terms of the deal, Nuuvera shareholders will receive $1 in cash plus 0.3546 of an Aphria share for each share they hold. Based on Aphria's 10-day volume weighted average price of $21.15, the offer is worth $8.50 per share.

``As part of Aphria, we will have access to every tool we need to open key international markets and execute on our growth plan as part of a stronger, well-resourced global cannabis leader,'' Lorne Abony, CEO of Nuuvera said in a statement.

The transaction is subject to customary closing conditions including approval by Nuuvera shareholders. Nuuvera shares closed at $7 on Friday, while Aphria shares finished last week at $20.16.

Assuming Aphria closes its acquisition of Broken Coast, that it also agreed to buy using stock and cash, Nuuvera shareholders will own approximately 14.8 per cent of the combined company.