Windsor-Essex brewers lament impact of looming 6.3% alcohol tax

Chapter Two Brewing Company in Windsor is celebrating a milestone this weekend.

“Five years! We're pretty pumped that we got this far and we're still going strong,” said brewery co-owner and general manager, Cheryl Watson. “It’s good news, I mean, we’ve gone through a lot.”

From the impact of lockdowns during the pandemic to recent inflationary pressures and wage increases, Watson notes the cost of doing business has been steep.

And that anniversary celebration will clouded by a looming alcohol excise tax increase on all alcohol producers.

“I think everything is just, it's been unpredictable for suppliers and buyers alike,” Watson said. “We have to look at and figure out what part of it you're going to cover and what part of it you're going to ask your customer to cover.”

That question will get harder on April 1 when the 6.3 per cent federal excise tax goes into effect on beer, wine and spirits producers.

Taxes already make up 50 per cent of the cost of beer, 65 per cent of the cost of wine and 75 per cent spirits, according to the Canadian Taxpayers Federation.

“The screws are tightening and we don't have as many places to play anymore,” said Watson.

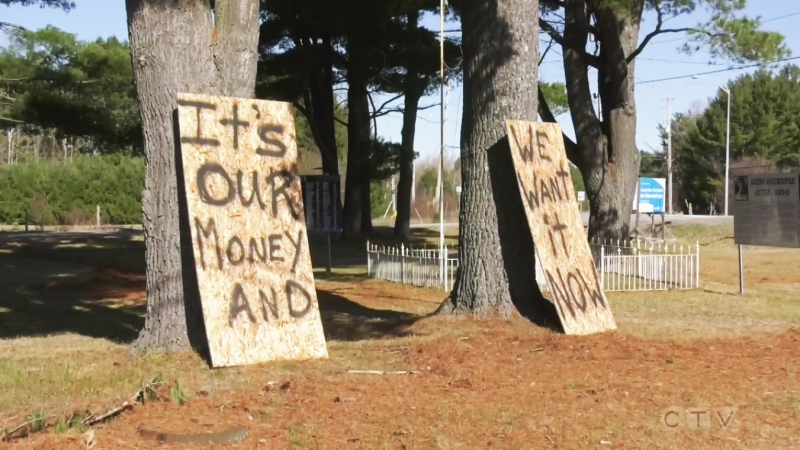

The increase on the table is triple the usual jump — a number tied directly to inflation — and has alcohol manufacturers wondering who is going to pick up the tab.

“You're going to see probably a six to 10 per cent increase on the price of your beer,” said Shane Meloche, the owner of Frank Brewing Company in Windsor. He’s weathered the storm that is the past few years in the hospitality industry and doesn’t want to raise prices but worries this time, he may have no choice.

“We're here to make money. We've got 20 to 30 people that work here. We need to stay in business,” Meloche said. “We want to keep everybody employed. So the only way to do that is to pass along that price to the consumer.”

Restaurants who sell alcohol will also feel the effects. A recent Restaurants Canada survey found about half of Canadian restaurants are operating just at or below profitability levels, noting the tax increase will cost Canada's food-service industry about $750 million a year.

“Their profit margins are very slim. And then when you have a six per cent increase, it's slimmer,” said Paul Boots, who along with business partner John Conlon launched Suds Runner just a few months back.

It’s a licensed manufacturing representative retailer for nine different Breweries in Ontario where customers can go online and order flights of beer from them that you can’t get at the LCBO or Beer Store — and they bring it to your door.

They started the venture to support local breweries and give their less popular brews more exposure for customers who can’t make it out to craft breweries as often as they’d like.

They hope the increase doesn’t crush their suppliers, customers, or them.

“It's important, I think, for people to understand that if the price is going up a little bit, it's not because they're making more money,” said Conlon.

“They're just trying to work, trying to make it work.”

CTVNews.ca Top Stories

Doctors say capital gains tax changes will jeopardize their retirement. Is that true?

The Canadian Medical Association asserts the Liberals' proposed changes to capital gains taxation will put doctors' retirement savings in jeopardy, but some financial experts insist incorporated professionals are not as doomed as they say they are.

Something in the water? Canadian family latest to spot elusive 'Loch Ness Monster'

For centuries, people have wondered what, if anything, might be lurking beneath the surface of Loch Ness in Scotland. When Canadian couple Parry Malm and Shannon Wiseman visited the Scottish highlands earlier this month with their two children, they didn’t expect to become part of the mystery.

Fair in Ontario, flurries in Labrador: Weather systems make for an erratic spring

It's no secret that spring can be a tumultuous time for Canadian weather, and as an unseasonably mild El Nino winter gives way to summer, there's bound to be a few swings in temperature that seem out of the ordinary. From Ontario to the Atlantic, though, this week is about to feel a little erratic.

What a urologist wants you to know about male infertility

When opposite sex couples are trying and failing to get pregnant, the attention often focuses on the woman. That’s not always the case.

He replaced Mickey Mantle. Now baseball's oldest living major leaguer is turning 100

The oldest living former major leaguer, Art Schallock turns 100 on Thursday and is being celebrated in the Bay Area and beyond as the milestone approaches.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Bank of Canada officials split on when to start cutting interest rates

Members of the Bank of Canada's governing council were split on how long the central bank should wait before it starts cutting interest rates when they met earlier this month.

Quebec nurse had to clean up after husband's death in Montreal hospital

On a night she should have been mourning, a nurse from Quebec's Laurentians region says she was forced to clean up her husband after he died at a hospital in Montreal.

Northern Ont. lawyer who abandoned clients in child protection cases disbarred

A North Bay, Ont., lawyer who abandoned 15 clients – many of them child protection cases – has lost his licence to practise law.