Windsor-Essex brewers lament impact of looming 6.3% alcohol tax

Chapter Two Brewing Company in Windsor is celebrating a milestone this weekend.

“Five years! We're pretty pumped that we got this far and we're still going strong,” said brewery co-owner and general manager, Cheryl Watson. “It’s good news, I mean, we’ve gone through a lot.”

From the impact of lockdowns during the pandemic to recent inflationary pressures and wage increases, Watson notes the cost of doing business has been steep.

And that anniversary celebration will clouded by a looming alcohol excise tax increase on all alcohol producers.

“I think everything is just, it's been unpredictable for suppliers and buyers alike,” Watson said. “We have to look at and figure out what part of it you're going to cover and what part of it you're going to ask your customer to cover.”

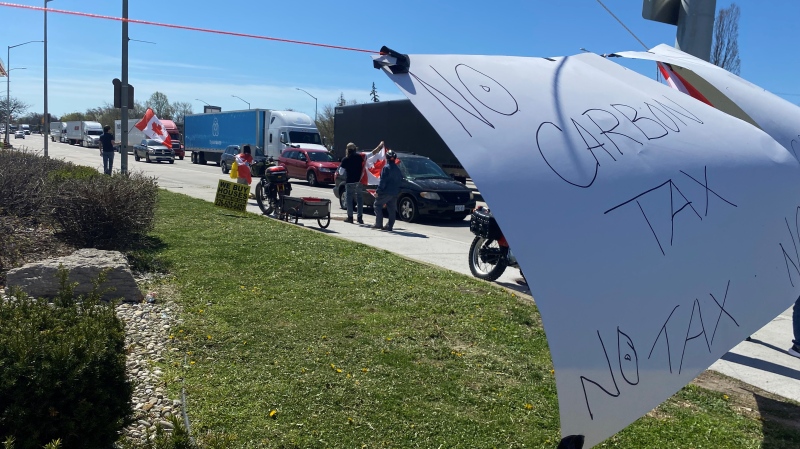

That question will get harder on April 1 when the 6.3 per cent federal excise tax goes into effect on beer, wine and spirits producers.

Taxes already make up 50 per cent of the cost of beer, 65 per cent of the cost of wine and 75 per cent spirits, according to the Canadian Taxpayers Federation.

“The screws are tightening and we don't have as many places to play anymore,” said Watson.

The increase on the table is triple the usual jump — a number tied directly to inflation — and has alcohol manufacturers wondering who is going to pick up the tab.

“You're going to see probably a six to 10 per cent increase on the price of your beer,” said Shane Meloche, the owner of Frank Brewing Company in Windsor. He’s weathered the storm that is the past few years in the hospitality industry and doesn’t want to raise prices but worries this time, he may have no choice.

“We're here to make money. We've got 20 to 30 people that work here. We need to stay in business,” Meloche said. “We want to keep everybody employed. So the only way to do that is to pass along that price to the consumer.”

Restaurants who sell alcohol will also feel the effects. A recent Restaurants Canada survey found about half of Canadian restaurants are operating just at or below profitability levels, noting the tax increase will cost Canada's food-service industry about $750 million a year.

“Their profit margins are very slim. And then when you have a six per cent increase, it's slimmer,” said Paul Boots, who along with business partner John Conlon launched Suds Runner just a few months back.

It’s a licensed manufacturing representative retailer for nine different Breweries in Ontario where customers can go online and order flights of beer from them that you can’t get at the LCBO or Beer Store — and they bring it to your door.

They started the venture to support local breweries and give their less popular brews more exposure for customers who can’t make it out to craft breweries as often as they’d like.

They hope the increase doesn’t crush their suppliers, customers, or them.

“It's important, I think, for people to understand that if the price is going up a little bit, it's not because they're making more money,” said Conlon.

“They're just trying to work, trying to make it work.”

CTVNews.ca Top Stories

Budget 2024 'likely to be the worst' in decades, former BoC governor says

Without having seen it, former Bank of Canada governor David Dodge believes that Tuesday's 2024 federal budget from Deputy Prime Minister and Finance Minister Chrystia Freeland is 'likely to be the worst budget' in decades.

What's at stake for Canada after Iran's unprecedented attack on Israel

Following the Iranian missile and drone strikes against Israel over the weekend, Canada should take the threat of Iran and potential escalation of the conflict seriously, one global affairs analyst says.

Former B.C. school trustee's 'strip-tease artist' remark was defamatory, judge rules

A controversial former school trustee from B.C.'s Fraser Valley who described a political rival as a "strip-tease artist" during an election campaign has been ordered to pay her $45,000 for defamation.

'A sense of urgency': Sask. man accused of abducting daughter calls himself to the stand during trial

Michael Gordon Jackson, the man on trial after being charged with contravention of a custody order for allegedly abducting his daughter in late 2021 to prevent her from getting a COVID-19 vaccine, called himself to the stand Monday.

Kingston, Ont.'s Aaliyah Edwards drafted into WNBA

After four years at the University of Connecticut, Edwards was selected sixth overall by the Washington Mystics in the WNBA draft Monday night.

NASA confirms mystery object that crashed through roof of Florida home came from space station

NASA confirmed Monday that a mystery object that crashed through the roof of a Florida home last month was a chunk of space junk from equipment discarded at the International Space Station.

A knife attack in Australia against a bishop and a priest is being treated as terrorism, police say

Horrified worshippers watched online and in person as a bishop was stabbed at the altar during a church service in Sydney on Sunday evening.

Body of 14-year-old boy pulled from Lake Ontario, police say he drowned while swimming

The body of a 14-year-old boy has been pulled from Lake Ontario after police say he drowned while swimming near Ashbridges Bay Park on Sunday night.

'Rust' armourer gets 18 months in prison for fatal shooting by Alec Baldwin on set

A movie weapons supervisor was sentenced to 18 months in prison in the fatal shooting of a cinematographer by Alec Baldwin on the set of 'Rust.'