Windsor-Essex brewers lament impact of looming 6.3% alcohol tax

Chapter Two Brewing Company in Windsor is celebrating a milestone this weekend.

“Five years! We're pretty pumped that we got this far and we're still going strong,” said brewery co-owner and general manager, Cheryl Watson. “It’s good news, I mean, we’ve gone through a lot.”

From the impact of lockdowns during the pandemic to recent inflationary pressures and wage increases, Watson notes the cost of doing business has been steep.

And that anniversary celebration will clouded by a looming alcohol excise tax increase on all alcohol producers.

“I think everything is just, it's been unpredictable for suppliers and buyers alike,” Watson said. “We have to look at and figure out what part of it you're going to cover and what part of it you're going to ask your customer to cover.”

That question will get harder on April 1 when the 6.3 per cent federal excise tax goes into effect on beer, wine and spirits producers.

Taxes already make up 50 per cent of the cost of beer, 65 per cent of the cost of wine and 75 per cent spirits, according to the Canadian Taxpayers Federation.

“The screws are tightening and we don't have as many places to play anymore,” said Watson.

The increase on the table is triple the usual jump — a number tied directly to inflation — and has alcohol manufacturers wondering who is going to pick up the tab.

“You're going to see probably a six to 10 per cent increase on the price of your beer,” said Shane Meloche, the owner of Frank Brewing Company in Windsor. He’s weathered the storm that is the past few years in the hospitality industry and doesn’t want to raise prices but worries this time, he may have no choice.

“We're here to make money. We've got 20 to 30 people that work here. We need to stay in business,” Meloche said. “We want to keep everybody employed. So the only way to do that is to pass along that price to the consumer.”

Restaurants who sell alcohol will also feel the effects. A recent Restaurants Canada survey found about half of Canadian restaurants are operating just at or below profitability levels, noting the tax increase will cost Canada's food-service industry about $750 million a year.

“Their profit margins are very slim. And then when you have a six per cent increase, it's slimmer,” said Paul Boots, who along with business partner John Conlon launched Suds Runner just a few months back.

It’s a licensed manufacturing representative retailer for nine different Breweries in Ontario where customers can go online and order flights of beer from them that you can’t get at the LCBO or Beer Store — and they bring it to your door.

They started the venture to support local breweries and give their less popular brews more exposure for customers who can’t make it out to craft breweries as often as they’d like.

They hope the increase doesn’t crush their suppliers, customers, or them.

“It's important, I think, for people to understand that if the price is going up a little bit, it's not because they're making more money,” said Conlon.

“They're just trying to work, trying to make it work.”

CTVNews.ca Top Stories

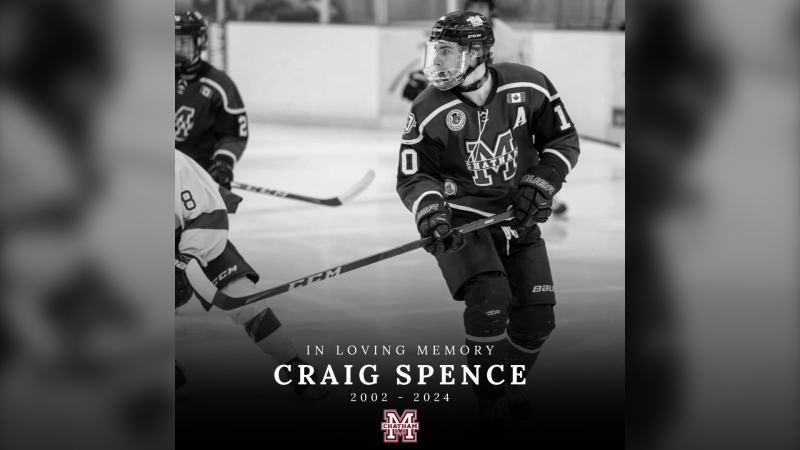

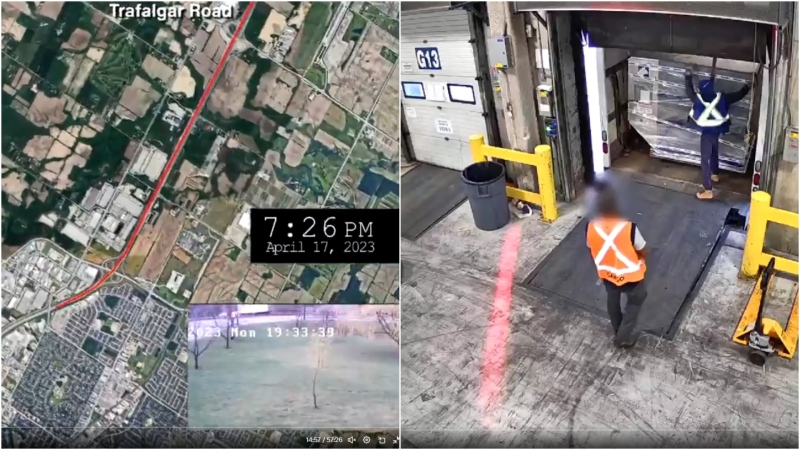

'They needed people inside Air Canada:' Police announce arrests in Pearson gold heist

Police say one former and one current employee of Air Canada are among the nine suspects that are facing charges in connection with the gold heist at Pearson International Airport last year.

Why drivers in Eastern Canada could see big gas price spikes, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

Toronto Raptors player Jontay Porter banned from NBA

Toronto Raptors player Jontay Porter has been handed a lifetime ban from The National Basketball Association (NBA) following an investigation which found he disclosed confidential information to sports bettors, the league says.

WATCH LIVE As GC Strategies partner is admonished by MPs, RCMP confirms search warrant executed

The RCMP confirmed Wednesday it had executed a search warrant at an address registered to GC Strategies. This development comes as MPs are enacting an extraordinary, rarely used parliamentary power, summoning one of its contractors to appear before the House of Commons to be admonished publicly for failing to answer questions related to the ArriveCan app.

Woman who pressured boyfriend to kill his ex in 2000s granted absences from prison

A woman who pressured her boyfriend into killing his teenage ex more than a decade ago will be allowed to leave prison for weeks at a time.

Attempt to have murder charge quashed against alleged serial killer dismissed by judge

A motion filed by the man accused of killing four Indigenous women in Winnipeg to have one of those murder charges quashed has been dismissed by the judge – weeks before the start of his trial.

Government proposes new policy for federally regulated employees to disconnect from work

In their 2024 budget, the federal government wants to amend the Canada Labour Code, so employers in federally regulated sectors will eliminate work-related communication with employees outside of scheduled hours. If implemented, this would affect roughly 500,000 across the country.

Earthquake jolts southern Japan

An earthquake with a preliminary magnitude of 6.4 hit southern Japan late on Wednesday, said the Japan Meteorological Agency, without issuing a tsunami warning.

Disappointment widespread over budget's proposed $200-month disability benefit funding

Advocacy groups across Canada are expressing widespread disappointment about the amount of funding earmarked in the 2024 federal budget for the long-awaited Canada Disability Benefit.