LaSalle and Windsor home insurance premiums are highest in Ontario

Basements and roads flood after heavy rainfall in Windsor and Essex County, on Monday and Tuesday, Aug. 29, 2017. (Courtesy Emily Watson)

Basements and roads flood after heavy rainfall in Windsor and Essex County, on Monday and Tuesday, Aug. 29, 2017. (Courtesy Emily Watson)

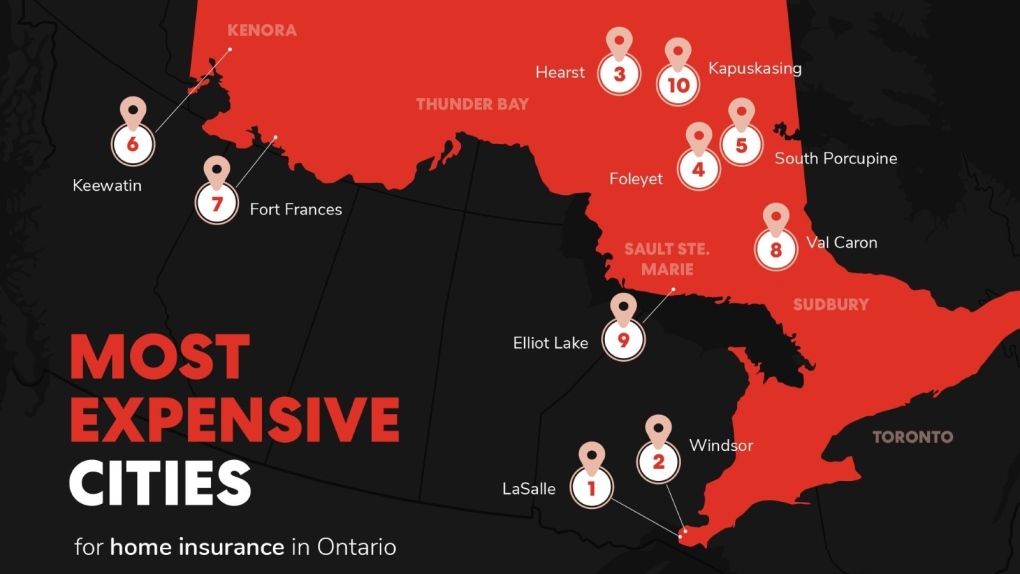

Homeowners in LaSalle and Windsor pay the highest average home insurance premiums in Ontario, according to a report from Rates.ca.

The average rate is $2,411 in LaSalle and $2,139 in Windsor.

Recent data from their Home Insuramap tool also shows that home insurance premiums in the province have increased approximately 10 per cent since Q3 2021.

“The topography of the Windsor region makes it more likely to flood than other Ontario cities. As incidents of severe weather increase across the country, flooding is a peril for which more and more insurance providers are adjusting coverage – all the more so in low-lying areas,” says Rates.ca expert and licensed insurance agent Tanisha Kishan.

“It has never been more important for Ontario homeowners to have water damage protection – where possible the greatest amount of protection available.”

Extreme weather, supply chain issues and inflation are all factors in rising home insurance prices in Ontario, driving up provincial premiums by 10 per cent and premiums in LaSalle and Windsor by 15 per cent and 3 per cent respectively.

Ajax has the lowest rate at $1,068. Homeowners in LaSalle and Windsor pay the highest average home insurance premiums in Ontario. (Source: Rates.ca)

Homeowners in LaSalle and Windsor pay the highest average home insurance premiums in Ontario. (Source: Rates.ca)

How to reduce your home insurance costs:

- Customize your policy: Start by identifying how much coverage you need. When tailoring your policy to your specific circumstance, you may be able to avoid paying for protection you’re comfortable going without.

- Compare quotes: Comparing quotes each time your policy is up for renewal is another critical step for reducing your home insurance costs. Providers can increase their premiums without the regulatory approval that’s necessary for increasing auto insurance rates. As a result, there’s a wide range of premiums available through different providers.

- Bundle: Another effective way to reduce costs is bundling. When each of your policies is held by a single provider, you’ll be eligible for a discount of up to 15%.

- Get flood protection: Though most home insurance policies protect against water damage (such as a burst pipe), flood protection often must be added to a policy. This means that unless you’ve purchased flood protection coverage, if your home is damaged by a flood, your home will not be protected.

- Install a back-flow valve: A back-flow valve will push water away from the home if sewer water begins to flood into the home, overflowing from drains and toilets. Many municipalities offer rebates for homeowners who are willing to install back-flow valves.

- Secure your home: When you take steps to manage or mitigate safety risks, you’re likely to receive a discount. For example, installing security, fire and carbon monoxide alarms will signal to the insurance provider that you’ve done what you can to protect your home from theft, fire and gas to help manage any risk they assume.

- Don’t smoke: Homeowners who don’t smoke may be eligible for a discount since home insurance providers identify their homes as less vulnerable to fire.

CTVNews.ca Top Stories

Trump suggests the U.S. should take back the Panama Canal. Could they do that?

Donald Trump suggested Sunday that his new administration could try to regain control of the Panama Canal that the United States 'foolishly' ceded to its Central American ally, contending that shippers are charged 'ridiculous' fees to pass through the vital transportation channel linking the Atlantic and Pacific Oceans.

Man handed 5th distracted driving charge for using cellphone on Hwy. 417 in Ottawa

An Ottawa driver was charged for using a cellphone behind the wheel on Sunday, the fifth time he has faced distracted driving charges.

Wrongfully convicted N.B. man has mixed feelings since exoneration

Robert Mailman, 76, was exonerated on Jan. 4 of a 1983 murder for which he and his friend Walter Gillespie served lengthy prison terms.

What's open and closed over the holidays in Canada

As Canadians take time off to celebrate the holidays, many federal offices, stores and businesses will be closed across the country on Christmas Day and New Year's Day.

opinion Christmas movies for people who don't like Christmas movies

The holidays can bring up a whole gamut of emotions, not just love and goodwill. So CTV film critic Richard Crouse offers up a list of Christmas movies for people who might not enjoy traditional Christmas movies.

Can the Governor General do what Pierre Poilievre is asking? This expert says no

A historically difficult week for Prime Minister Justin Trudeau and his Liberal government ended with a renewed push from Conservative Leader Pierre Poilievre to topple this government – this time in the form a letter to the Governor General.

More than 7,000 Jeep SUVs recalled in Canada over camera display concern

A software issue potentially affecting the rearview camera display in select Jeep Wagoneer and Grand Cherokee models has prompted a recall of more than 7,000 vehicles.

'I'm still thinking pinch me': lost puppy reunited with family after five years

After almost five years of searching and never giving up hope, the Tuffin family received the best Christmas gift they could have hoped for: being reunited with their long-lost puppy.

10 hospitalized after carbon monoxide poisoning in Ottawa's east end

The Ottawa Police Service says ten people were taken to hospital, with one of them in life-threatening condition, after being exposed to carbon monoxide in the neighbourhood of Vanier on Sunday morning.